Why DO I have To Pay My Deductible???

Most people don’t plan for a hail or wind storm. Most of us would prefer if they just never happened.

Damage from hail and wind storms can be expensive. That’s why you have property and casualty insurance!

But if you have insurance on your home or building why do you have to pay out of pocket when there is damage from a storm?

What Is A Deductible?

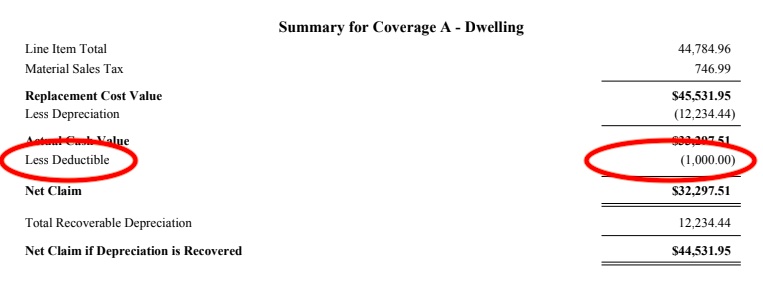

Let’s start off by identifying what a deductible is on your insurance claim.

According to American Family Insurance a homeowners insurance deductible is “the amount of money you’ll pay out of pocket before your insurance company will pay on the claim.”

Rocket Mortgage explains a deductible as “the amount of money a homeowner must pay out of pocket before homeowners insurance coverage kicks in.”

US News describes a deductible as “the amount that a homeowner must pay before their insurance steps in to cover the remaining expenses on a claim.”

A common comparison to a deductible on a homeowners insurance claim is a “copay” on a medical insurance claim.

Essentially, a deductible is the dollar amount that you agreed to pay if there was a covered loss when you signed up for your policy.

Can A Roofer Pay My Deductible?

In the roofing industry it has been common practice over the years to offer to “pay” a deductible for a homeowner if they have a hail or wind damage insurance claim.

In past years deductibles could be as low as $250-$500.

Roofers would offer to “pay” the deductible for the homeowner so they were essentially getting a “free roof” and didn’t have to pay anything out of pocket.

This is a problem for a few reasons that we will discuss below.

It is important to note that some states, such as Colorado and Texas, have laws in place that make it explicitly illegal for a roofing contractor to pay a deductible.

Why can’t a roofer pay my deductible?

Many insurance policies require the deductible to be paid before payment is issued

You signed a contract agreeing to pay your deductible when you purchased your policy

There are laws in Texas and Colorado that make it illegal for a roofer to pay a deductible on an insurance claim

Many times a roofer has to produce a false or fraudulent invoice to the insurance company showing that you paid your deductible

Some insurance companies are requiring proof that the deductible has been paid

One of the things we tell people when they are considering using a roofer who will pay their deductible is “If they’re willing to commit fraud against your insurance company, think about what they are willing to do to you!”

What we mean by this is that if the roofer is willing to produce a false invoice to a multi-billion dollar insurance company, they are probably willing to take advantage of a homeowner!

Laws Making It Illegal

Because so many roofers were paying deductibles for homeowners on insurance claims a few states decided to pass their own laws to control the problem.

Colorado and Texas are two of these states that have laws making it illegal for a roofing contractor to pay a deductible on an insurance claim.

In 2012 the Colorado Senate passed bill 12-38. Senate Bill 38 (SB38) was designed to protect consumers and insurance companies while regulating the residential roofing industry.

According to Merlin Law Group the bill also requires roofing contractors to sign a written contract that includes the following;

The costs of the services;

The roofing contractor’s contact information;

Identification of the roofing contractor’s surety and liability coverage insurer and their contact information, if applicable;

The roofing contractor’s policy regarding cancellation of the contract and refund of any deposit, including a rescission clause allowing the client to rescind the contract and obtain a full refund of any deposit within 72 hours after entering the contract; and

A written statement that if the client plans to use the proceeds of a property or casualty insurance policy to pay for the roofing work, the roofing contractor cannot pay, waive, rebate, or promise to pay, waive, or rebate all or part of any deductible applicable to the claim for payment for roofing work on the covered residential property.

In 2019 Texas passed a similar bill. According to Lane Law HB2102 states the following;

Sec. 27.02. GOODS OR SERVICES PAID FOR BY INSURANCE PROCEEDS: PAYMENT OF DEDUCTIBLE REQUIRED [CERTAIN INSURANCE CLAIMS FOR EXCESSIVE CHARGES].

(A) In this section, “property insurance policy” has the meaning assigned by Section 707.001, Insurance Code.

(B) A contract to provide a good or service that is reasonably expected to be paid wholly or partly from the proceeds of a claim under a property insurance policy and that has a contract price of $1,000 or more must contain the following notice in at least 12-point boldface type: “Texas law requires a person insured under a property insurance policy to pay any deductible applicable to a claim made under the policy. It is a violation of Texas law for a seller of goods or services who reasonably expects to be paid wholly or partly from the proceeds of a property insurance claim to knowingly allow the insured person to fail to pay, or assist the insured person’s failure to pay, the applicable insurance deductible.”

In plain English, the HB2102 Texas deductibles law is a win for reputable roofing contractors. This is because it will punish other contractors who waive or don’t collect insurance deductibles from their clients.

According the the Texas Department of Insurance roofers paying deductibles is harmful because;

“Contractors who say they will waive your deductible might be sending false information to your insurance company about the cost of repairs. That would be fraud. And a contractor who offers to waive your deductible is likely making up the difference by cutting corners or using lower quality products. That can lead to more claims and repairs later.”

So I Really Have To Pay My Deductible?

Yes, you do! And we are sorry!

But, we have options for you!

Finance your deductible – We offer financing through multiple third party lenders! A project consultant can discuss your options with you

Use a credit card – We accept all major credit cards! Use your credit card for your deductible and get miles or points!

Use FundMyDeductible.com – We have also partnered with a company who will finance your deductible! Click here for more info.

0 Responses